Finance

There are many interesting optimization problems in finance, including: portfolio optimization, risk management, option pricing, and investment decision support.

Key features of this model:

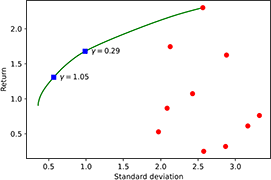

- Description: Shows how to do portfolio optimization using CVXPY, maximizing risk-adjusted return.

- Category: Finance.

- Type: Non-linear convex.

- Library: CVXPY.

- Solver: OSQP.

Notes:

- This model is part of a convex optimization course at Stanford University.

- The notebook includes several variations of the portfolio optilization model.

GitHub: Portfolio optimization in CVXPY.